Dear Reader,

In 2008, OptionSizzle was started to help everyday investors get insights into where big directional bets are placed in the options market.

This type of activity is a foreshadowing indicator into future price movement in stocks that can generate massive returns.

Since then, our trading research service has helped thousands of investors beat the market following this options activity.

"Service yields consistent and profitable outcomes"

-Scott E.

"Knowledgeable and patient mentor for beginners"

-Rasa B.

"Educator and consistent money maker"

-Jay W.

"I hit 7 out of 10 trades I make following Josh's system and recommendations"

-Eric H.

To date, we’ve been able to reach over 1,000,000 people.

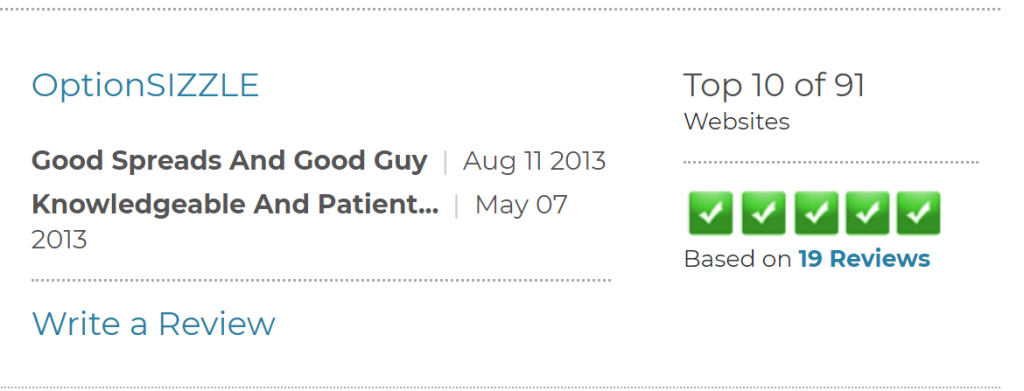

And we’ve been voted top 10 websites in the world.

So now, as we enter a new decade of our trading services, we've taken another big step towards putting it ALL together for you at CounterVest.com.

It’s our new online community where average investors can learn the secrets of a Wall Street “insider” – to beat the market and create a worry-free retirement.

Our focus is to provide you with everything you need to become an all-around successful investor – and get rich.

Your first step in taking this journey with us is by joining our FREE e-newsletter Emerging Profits Daily.

To your wealth, freedom, and options!

Joshua M. Belanger

Founder & Managing Director